Money is one of the most powerful drivers of decision-making in society. There are people who devote most of their lives to acquiring, growing, and keeping money. Money, by nature, is emotional to people at multiple stages in their lives. So when Grand Studio is looking to build products and services around something that touches the very core of people, it’s imperative on us to understand the emotional connections that exist there, as well as the responsibility we have to respond in kind. Whether we are designing products for personal banking, investments, or brand-new fintech opportunities, building up the emotional intelligence in our products can create stronger, more meaningful connections with customers, leading to long-term success for the brand.

What does it mean to have emotionally intelligent products?

Products and services with a high degree of emotional intelligence are ones that are born from an understanding of customer pain points (the inputs) and deliver solutions that spark more optimistic outcomes for customers (the outputs). They do not need to be overly complex nor hyper-personalized experiences to start. However, they do a fine job at easing pains, providing guidance when needed, offering options, and creating moments of delight. This is about creating empathy for our audiences and providing solutions to address their needs.

Banking on positive attitudes

The experiences we create in consumer banking need to feel tailor-fit for where consumers are in their financial journey in order to create those meaningful connections. Your audience might be afraid of low balances, trapped by debt, confused about saving, frustrated at small tasks like trying to wire someone else money, or looking for new opportunities to grow their wealth. Any of these scenarios point to pains that our solutions can address, but we can do so with a friendly experience. In the end, we are looking to help customers create the right type of changes in their financial lives that puts them on the path toward greater confidence.

Measuring emotional intelligence

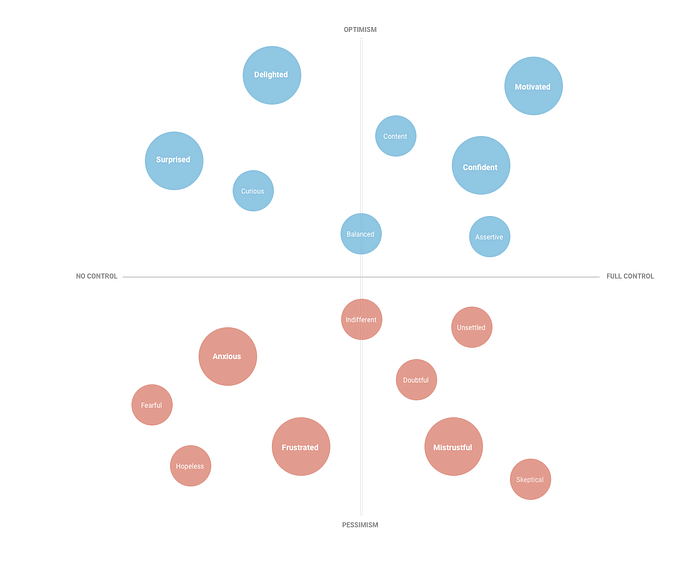

It might seem difficult at first to connect user emotions to your existing products. A helpful activity I’ve found is to conduct field research to understand where your product is contributing to good feelings or perhaps may be falling short. Talk to your customers, get perspective on what your product is doing and how that makes them feel given their financial goals. This spectrum can help your customers identify where your product currently stands:

This diagram sits on the spectrum of emotional states (based on optimism vs. pessimism) as well as the level of control afforded to users (full control vs. no control). If your product comes with a high sense of emotional intelligence, it would pass through areas of optimistic emotion for users. It will solve problems that hit users at their core, it will make them feel respected and delighted, and at best it can truly motivate them to behave in their own best interests.

Where do most products and services fit in?

The majority of products and services generally scratch the surface of gaining customer loyalty (represented by the bell curve). It all comes back to emotional intelligence, which understands what the product can provide, where the user is in their journey, and how a set of features can drive good behavior and positive feelings. To get to aspirational places like surprise, delight, and motivational — it requires extra focus on the combination of offerings and convenience that solve real needs for users. All of this creates long term engagement and customer loyalty.

What if these products fall short?

If however your product fails to inspire people, if it actually causes frustration and deterrence, then it is at risk of abandonment by your customer base. I would expect users to describe the impact of your product toward the bottom half of the spectrum:

Products that fall down here in the bell curve are generally met with indifference or considered not useful enough. The value proposition either doesn’t match the individual (wrong audience) or it doesn’t solve a real need (wrong value). This is often met with emotions like frustration, anxiety, and mistrust. In financial services, this can have very grave consequences when handling a customer’s money. This is often seen in support tickets and complaints. Fees for example are a big-ticket item. Inconveniencing the customer. Mishandling money. Timeliness. Any of these could easily propel a customer to switch to your competitor.

Measuring emotions leads to a plan with momentum

While most products that fail to connect generally fall into a zone of customer indifference or doubt, it’s helpful to get a reality check on where your product stands and ultimately determine how far you need to move your audience to get to a place of higher emotional intelligence.

This can create a roadmap for you in terms of where you are starting with your customers to gain their trust. From there, it is helpful to continue a cycle of customer learning as you provide solutions and test if they are generating the right emotional resonance with your audience.

How to build emotional intelligence into products

This is all about becoming aware of the potential impacts your product has on its audience and managing that responsibility appropriately. Fintech products today often try to do too much and could benefit from more focus in areas that create the right type of emotional responses from customers. There are several key areas to consider when creating a more rewarding user experience:

Start with the audience you have

Designing for everyone creates too much pressure to please everyone. In the world of finance, we need to be extra careful about not turning away customers and look to create experiences that inspire optimism. This starts with identifying your current audience before branching out to acquire a new one.

Find the value

This one is absolutely key. Do some quantitative and qualitative research with your audience to know more about their financial journeys, where there are common patterns, and what features could actually solve their problems — turning frustration and anxiety into more confidence-building emotions. Have them evaluate your current product along the emotional intelligence spectrum above. We want to ensure that your potential solutions can solve real needs for them.

Provide the right balance of user control

There is no right formula here as to what level of control will give users the confidence they need to feel financially secure and confident to conduct activities on your platform. This is something that needs to be tested and evaluated often to ensure you are receiving the right emotional responses from your audience. Perhaps there are parts of your experience you want to remove control and create more discovery, leading to surprise. Products that do this well often experiment with rewards and game-like experiences to keep users engaged.

Delight customers whenever you can

The nice, little touches can add up to big impacts for experience. Spend the extra effort to make users feel great about paying off a balance, successfully transferring money, or taking ownership over their financial future. Make it fun to interact with your product.

All that said, it’s worth considering your organization’s brand and tone. Messaging is just as important, so your products should have the ability to fit into the ecosystem of your other products and services, whether they be online, offline or a combination.

Which products are doing this well?

Venmo

Now owned by PayPal, Venmo became the juggernaut it is today because it stuck to a narrow focus and didn’t try to do everything all at once. On the surface it was seen as a new wave of social money transfer and it really spoke to a slice of the demographic pool ready to embrace mobile-first. If we peel back further we know that it certainly does one thing particularly well — it can connect to virtually any bank and transfer money fast to your friends. No longer did users have to figure out the costs of external transfers from their bank’s websites. Venmo created a wealth of convenience up front but spoke to its user base in a way that made money transfer fun. Not only did it ease pains and frustrations, but it promoted itself as entertaining. This is a clear example of an offering that aims to eliminate frustrating experiences while the way it is designed creates moments of pure delight. Who knew that sharing burrito emojis in a FinTech app could be so satisfying?

Mint

Now owned by Intuit, Mint was one of the first online platforms to become an aggregator for retail banking data — realizing that their target audience had accounts across multiple banks and investment firms, they streamlined all of that into one secure experience to allow users to track the flow of money and stay on top of their financial futures. Where there was initially confusion, doubt, and anxiety came clarity and motivation to take control over transactions and spend history. Over time Mint has slowly added to its capabilities by assessing user needs and responding to them accordingly, like the addition of budget tracking and financial goals. The platform achieved focus, built a critical mass, and delivered a delightful experience.

Digit

Digit is an interesting pick because it doesn’t have a traditional user interface. It started a few years ago as a conversational interface or chatbot. But you could talk to that chatbot like a friend or an assistant to move around money between your checking account and your rainy day fund. The platform’s secret sauce is that it monitors your spending habits and automatically transfers funds to the rainy day account without you noticing the dip in your account. It periodically sends you text messages to let you know how much you’ve saved on occasion and does so with a delightful attitude. Users were shocked at how much they ended up saving in a short amount of time without having to think about an optimal strategy. Machine learning did that all for them.

Credit Karma

Credit Karma was one of the first real players to truly open up credit score information to individuals without trapping them in a subscription payment cycle. Not only do they provide excellent information as to reasons why scores may have gone up or down over time but they provide helpful recommendations of which credit cards a customer may be eligible to pursue. The larger banks have now adopted the ability to check credit scores but Credit Karma was one of the first to solve for feelings of confusion and doubt in their customers.

Chime

With similarities to the banking app Simple before it, Chime is looking to upend traditional banking competitors by offering a one-stop solution for mobile banking. This has been tried many times before in the past decade yet Chime seems to be breaking through right now. They are reaping the benefits of acquiring new customers due to some long held friction by more traditional banks — like account fees. Promising no fees is just the start for them. They are also taking advantage of financial automation for saving money, ability to send payments to anybody (like Venmo), and celebrating paydays for their users. To top it off, they are relentless about protecting user privacy, data, and giving users control to freeze their account should they lose their debit card. This all translates into a seamless experience for the average customer: creating feelings of security, confidence, and motivation to continue a true partnership with Chime.

Consumer banking continues to be emotional

In the world of finance — creating empathy for customers, meeting them where they are at in their journey, and celebrating the good times are all key to creating brand loyalty with our products and services. It’s important for us to not forget that money is indeed emotional, and our customers view their situations differently because everyone is on their own journey and have financial goals that are deeply personal.

When we are looking to revamp existing experiences or to create entirely new ones, it’s important that we consider how we want people to feel while using our products. We want to make sure we are laying the groundwork for a true partnership between the company and its customers. Transforming your process to be more user-centric and opting to build emotional intelligence will undoubtedly give you the right framework to measure success. Doing so upfront will be the best investment your company makes, an investment in its customers, so that everyone moves forward on the right path.

Want to learn how Grand Studio can help with your next project and build clarity out of complexity?

We’re here to help!